Cash Flow Rankings of Listed Medical Device Companies Released (with List Attached)

Source | Saisailan Medical Devices

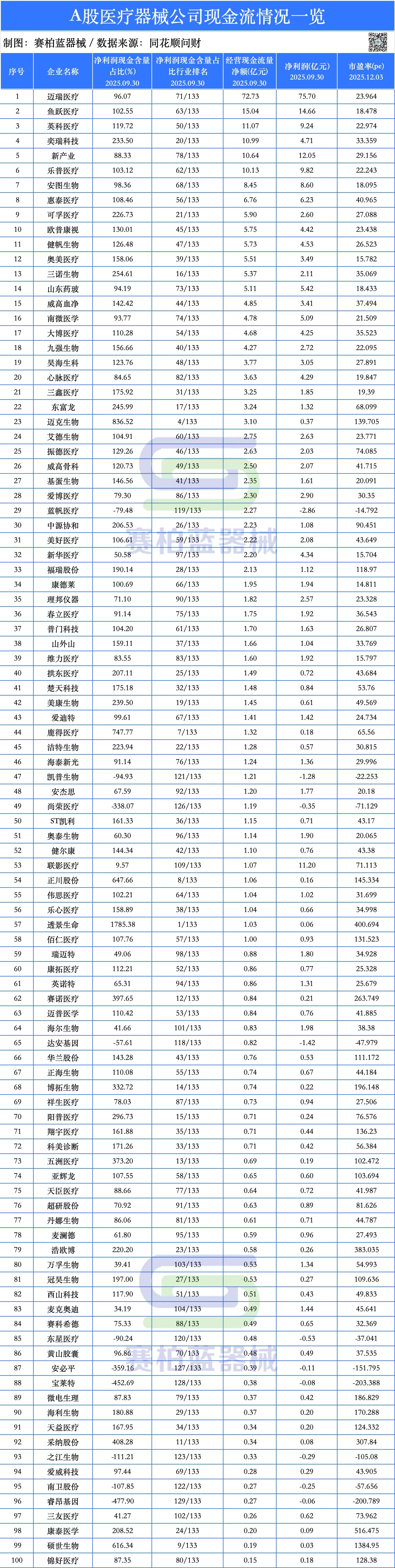

01 Comparison of Cash Flow Among A-Share Medical Device Companies

According to data from Tonghuashun Wencai, as of September 30, 2025, the top 10 A-share listed medical device companies by net operating cash flow are Mindray, Yuyue Medical, Intco Medical, iRay, Snibe, Lepu Medical, Autobio, Huirui Medical (HTWM), Co-foe Medical, and Opcom. Among the top 10, except for Mindray, Snibe, and Autobio, the operating cash flow of other companies exceeds their net profit. iRay has the highest net profit cash content ratio at 233.5%.

Cash flow serves as a key litmus test for distinguishing company development quality. Medical device companies with healthy cash flow possess the long-term ability to translate technological and market advantages into free cash flow. During the current phase where the medical device industry faces overall growth and profit pressure, stable cash flow has become an important reference for the market to assess a company's development status.

According to China Merchants Securities statistics, the overall net operating cash flow of the medical device sector decreased by 5.4% year-on-year in the first half of the year, and by 3.8% year-on-year in the second quarter. Accounts receivable and contract assets increased slightly by 0.6%, while advances from customers and contract liabilities decreased slightly by 0.8%.

In the Q2 2025 period, against the backdrop of declining overall revenue for A-share listed medical device companies, although the absolute value of accounts receivable remained largely flat, its proportion to revenue showed an upward trend, leading to a decline in net operating cash flow levels. For H1 2025, the industry's overall net operating cash flow was 14.5 billion yuan, a year-on-year decrease of 5.4%. For Q2 2025, the overall net operating cash flow was 10.4 billion yuan, a year-on-year decrease of 3.8%.

02 Short-Term Challenges and Long-Termism: Domestic Medical Devices Increasingly Focus on Original Technologies

The medical device industry is relatively unique, combining attributes of healthcare, consumer goods, and technology. It is characterized by strong regulation and long cycles. Some growth-oriented businesses require continuous high R&D expenditure, directly consuming operating cash flow.

Simultaneously, accounts receivable management, employee headcount and compensation, and major M&A activities can all impact a company's short-term cash flow. For instance, in the first half of this year, Mindray's net operating cash flow decreased by 53.8% year-on-year, with operating cash inflow dropping by 17.3%. For the first three quarters, Mindray's net cash flow from operating activities was 7.27 billion yuan, a decrease of 34.32% compared to the same period last year.

The primary reason for the significant decline in Mindray's net cash flow was a 4.4% increase in operating cash outflow. Mindray explained that the growth in operating cash outflow was mainly due to two factors: first, cash paid to and on behalf of employees increased by 11.6%, primarily because the company typically distributes previous year's bonuses in the first quarter, and both total employee count and average compensation increased last year; second, cash paid for goods and services received increased by 3.5%, as the company still imports some materials. To ensure supply chain security and mitigate tariff risks, the company's short-term response has been to increase strategic reserves of these materials.

Mindray officially initiated its Hong Kong listing process on October 14th this year. Regarding the relationship between the Hong Kong listing and financing, Mindray stated that the company has healthy cash flow and capital reserves, and financing is by no means the core purpose of the Hong Kong IPO.

United Imaging Healthcare, ranked second by market capitalization on the A-share market, has a net operating cash flow ranking of only 53rd among the 133 A-share listed medical device companies tracked by Wencai. Its profit cash content ratio ranks 109th in the industry. However, its operating cash flow showed significant improvement in the first three quarters. Financial reports indicate that net cash flow from operating activities for the first three quarters was 107 million yuan, a year-on-year increase of 107.1%, achieving a shift from negative to positive, which is noteworthy in the capital-intensive medical device field.

However, the cash flow pressure faced by United Imaging remains evident. By the end of the first half of 2025, United Imaging's net operating cash inflow was less than 50 million yuan. Although the Q3 report showed improvement to 107 million yuan, the absolute level remains relatively low.

Among the 133 A-share medical device companies tracked by Wencai, as of the first three quarters reporting period, United Imaging ranks first in accounts receivable, reaching 5.21 billion yuan, with accounts receivable days outstanding of 145 days.

Nevertheless, for medical device companies in their growth phase or focused on innovation in specific business segments, quarterly fluctuations in operating cash flow due to substantial R&D investment and business expansion are considered normal.

For example, United Imaging's R&D investment for the first three quarters of 2025 reached 1.855 billion yuan, second only to Mindray, representing a year-on-year increase of 13.48% and accounting for 20.94% of its operating revenue. After years of continuous investment, United Imaging recently officially launched products in its ultrasound segment, and its future profitability is anticipated.

Currently, domestic medical device companies are transitioning from the substitution phase to the "globally first-in-class" tier. The pace of innovative device approvals is accelerating, and corporate R&D investment is translating into commercialization results.

In cardiovascular intervention, "intervention without implantation" technology is advancing rapidly, exemplified by products like MicroPort's Firelimus drug-eluting balloon, Firesorb bioresorbable scaffold, and Sino Medical Sciences' iron-based bioresorbable scaffold. In structural heart disease, domestic technologies are filling previous gaps, such as Peijia Medical's TaurusNXT dry valve and Beijing Balance Medical's Renato valve-in-valve. In electrophysiology, domestic and imported PFA (Pulsed Field Ablation) technologies are running neck and neck, with domestic approvals significantly outnumbering imports, including products like Huirui Medical's "circular + linear" dual-catheter solution and MicroPort EP's self-developed pressure-sensing catheter.

Domestic medical device companies are gradually moving beyond the substitution stage and aligning with original technologies. As Mindray previously stated, R&D is no longer "market competition"-driven imitation or following, but rather independent innovation based on "customer needs," focusing on original technologies, mastering core technologies, and breaking free from homogeneous competition.

The latest data from the Medical Device Supply Chain Branch of the China Federation of Logistics & Purchasing indicates stable and progressive development in China's medical device market for 2025. According to incomplete statistics, the annual market size is expected to reach 1.22 trillion yuan. Innovative segments have performed particularly well, becoming the core driving force for industry growth. As of the end of October 2025, the number of approved innovative medical devices has increased to 377, with the full year expected to set a new record.

What domestic medical device companies are achieving is not merely technological breakthroughs, but a collective release of commercial efficiency, moving away from homogeneous competition toward new incremental growth dynamics.