Medical Device Giant Sells Three Business Units for $14.3 Billion

Another major medical device company undergoes significant transformation.

01

$2.03 Billion

Teleflex Sells Three Business Units

On December 9 local time, Teleflex announced the sale of its Acute Care, Interventional Urology, and Original Equipment Manufacturer (OEM) businesses for $2.03 billion (approximately RMB 14.3 billion). The transaction has been approved by Teleflex's board of directors and is expected to close in the second half of 2026, subject to customary regulatory approvals and other closing conditions.

In February of this year, Teleflex had indicated plans to spin off its Urology, Acute Care, and OEM businesses via an initial public offering.

The plan has now changed. According to the latest news, these three businesses will be sold to two separate buyers. Intersurgical® Ltd will acquire the Acute Care and Interventional Urology units, while Montagu and Kohlberg will acquire the OEM business.

Under the terms of the agreement, Teleflex will receive approximately $1.5 billion in proceeds from the sale of its OEM business and approximately $530 million from the sale of its Acute Care and Interventional Urology businesses. On a consolidated basis and after certain closing adjustments, Teleflex expects to receive net after-tax proceeds of approximately $1.8 billion.

Additionally, Teleflex announced that its board has approved a share repurchase program of up to $1 billion of the company's common stock. The program will be funded primarily from the proceeds of the sales transactions.

On the day of the announcement, Teleflex (TFX) stock closed up 9.54% at $131.25 per share.

Liam Kelly, Chairman, President, and CEO of Teleflex, stated, "Over the past year, we have executed a clear strategy to optimize our portfolio and position Teleflex for the future, focusing on driving growth in our core critical care and high-acuity hospital markets. This transaction makes Teleflex a more focused medical technology leader with highly complementary businesses in Vascular Access, Interventional, and Surgical, and simplifies our global operating model and manufacturing footprint."

Liam Kelly further noted, "Following these transactions, Teleflex will have greater flexibility to invest in innovation and compete in these priority markets. We are confident in Teleflex's mid-single-digit growth profile."

In February of this year, Teleflex also announced the acquisition of Biotronik's Vascular Intervention business for approximately €760 million.

Post-acquisition, Biotronik's coronary products will highly complement Teleflex's complex Percutaneous Coronary Intervention (PCI) platform, expand and enhance its traditional Interventional sales force and portfolio, and establish a global footprint in the fast-growing Peripheral Intervention market. This will further strengthen Teleflex's innovation pipeline and allow it to participate in the emerging potential market for absorbable stent technology.

02

Buying and Selling to Focus on Core Growth

Teleflex's moves to both acquire and divest exemplify the current trend among global medical device industry giants to proactively drive change and reshape their business portfolios.

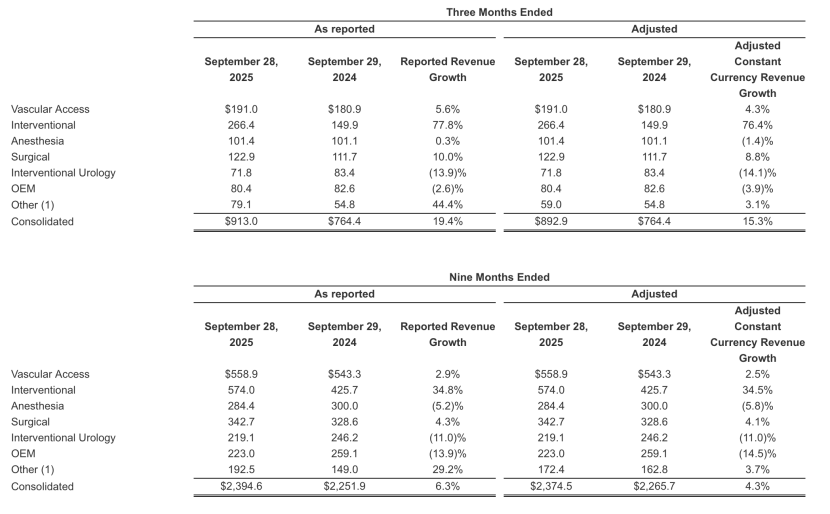

Financial reports show that Teleflex's revenue for the first three quarters of 2025 was $2.395 billion, a year-over-year increase of 6.3%. Third-quarter revenue was $913 million, up 19.4% year-over-year, with growth in the Interventional segment offsetting declines in Urology and OEM.

After divesting the underperforming units, a streamlined Teleflex will be able to focus more intently on its core growth businesses.

By shedding non-core or slower-growth divisions and acquiring assets that strengthen core advantages, the medical device industry is accelerating its concentration into high-growth, high-margin niche areas.

In October, Johnson & Johnson announced its intention to spin off its Orthopaedics business. Upon completion, DePuy Synthes will operate as an independent orthopaedics company. Orthopaedics is no longer the primary growth driver within J&J's MedTech segment. As early as 2023, J&J initiated a restructuring plan for the orthopaedics unit within its MedTech segment. The move towards a spin-off now clearly demonstrates its resolve to focus on higher-growth and innovative fields.

In July, BD (Becton, Dickinson and Company) announced it would sell its Biosciences and Diagnostic Solutions businesses through transactions valued at $17.5 billion. Subsequently, BD will focus on its Medical and Interventional segments.

For its diagnostics business, which has seen some performance decline, Abbott has chosen to invest heavily, yet also with a focus on high-potential areas.

Just last month, Abbott announced the acquisition of Exact Sciences, a leader in cancer screening and precision oncology diagnostics. The transaction involves total equity value of approximately $21 billion (about RMB 1.493 trillion), potentially making it the largest healthcare industry M&A deal this year. This acquisition will allow Abbott to enter and lead the rapidly growing field of cancer diagnostics.

Strategic focus on high-growth areas and securing positions in cutting-edge innovation have become key imperatives for device giants in their current transformation efforts.