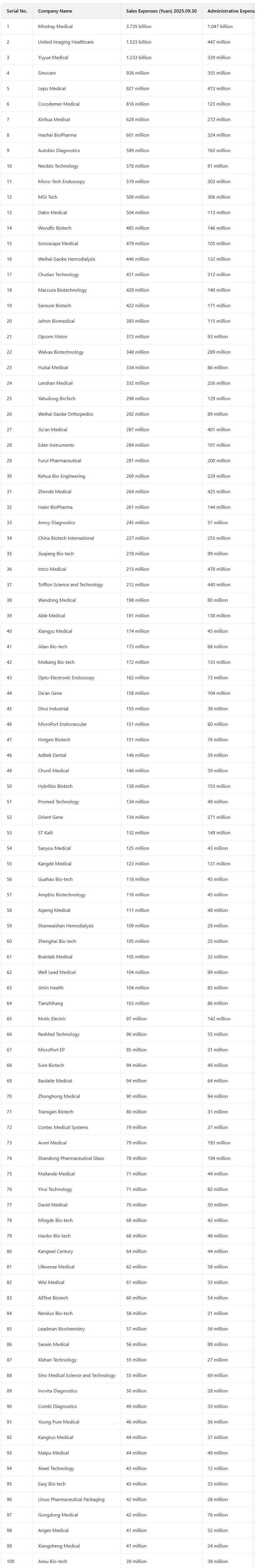

Listedeki Tıbbi Cihaz Şirketlerinin Satış Giderleri

01

IVD Satış Gider Oranı Önemli Ölçüde Arttı

IFinD verilerine göre, 2025 yılının ilk üç çeyreğinde A-hisseli borsada yer alan en büyük 100 tıbbi cihaz şirketinin toplam satış giderleri 26.82 milyar yuan seviyesine ulaştı. İlk 10 şirket sırasıyla Mindray Medical, United Imaging Healthcare, Yuyue Medical, Sinocare, Lepu Medical, Cocodemer Medical, Xinhua Medical, Haohai BioPharma, Autobio Diagnostics ve Neobio Technology'dir.

Bu şirketler arasında satış gider oranları %10'un altında olan 18 şirket, %10-%20 arası olan 34 şirket, %20-%30 arası olan 28 şirket, %30-%40 arası olan 13 şirket ve oranın %40'ı aşdığı 7 şirket bulunmaktadır. Tianzhihang'ın satış gider oranı %54,82 ile en yüksek seviyededir. Bu yıl ocak ile eylül arasında şirket yaklaşık 187 milyon yuanlık faaliyet geliri elde etti ve bu rakam bir önceki yıla göre %103,51 arttı. Şu anda yurt içi cerrahi robotları hâlâ büyüme aşamasında olup genel olarak yüksek Ar-Ge gider oranlarına ve satış gider oranlarına sahiptir.

Intco Medical, Zhonghong Medical ve Shandong Pharmaceutical Glass gibi şirketlerin satış gider oranları nispeten düşüktür ve bu durum büyük ölçüyle ilgili alt sektörlerle ve nispeten düşük brüt kâr marjlarıyla ilişkilidir.

A Hisselerinde İşlem Gören Tıbbi Cihaz Şirketlerinin Satış Giderlerine Genel Bakış

Grafik: Cyberlan Medical / Veri Kaynağı: iFinD

Satış gider oranı büyük ölçüyle sektörel özelliklere, ürün özelliklerine, dağıtım kanalı modellerine ve diğer faktörlere bağlıdır. Tıbbi cihaz şirketlerinin satış giderleri başlıca pazarlama tanıtım giderlerini, satış personeli maaşlarını, müşteri ikram giderlerini, seyahat giderlerini, akademik tanıtım giderlerini vb. kapsar.

Huaxin Securities'in analizine göre 2023'ten 2025'e kadar tıbbi cihaz sektörünün genel satış gider oranı hafif artan bir eğilim göstermiş ancak temelde küçük dalgalanmalarla seyretmiştir. Ar-Ge gider oranı temelde %8-9 arasında kalmış, 2025'te hafif bir düşüş yaşanmış ancak önemli bir gerileme olmamıştır.

Özellikle 2023 ile 2025 yılları arasında tıbbi ekipman alanında satış gider oranı artmıştır. Şirketlerin gelir büyümesini desteklemek için daha fazla satış kaynağına yatırım yapması gerekebilir. Tıbbi sarf malzemeler alanında satış gider oranı genel olarak hafif bir şekilde düşmüştür ve bu durum merkezileştirilmiş satın almaların ardından satış gider yatırımlarının azalmasıyla ilişkilidir.

İn vitro tanı (IVD) alanında satış gider oranı en belirgin şekilde artmış olup, 2023 yılının ilk çeyreğinde %15,87'den 2025 yılının üçüncü çeyreğinde %22,83'e yükselmiştir. Bu yıl ocak ayından eylül ayına kadar sürekli artış göstermiş ve şu anda diğer iki sektörden önemli ölçüde yüksektir. Ana nedenler, satış giderlerinin görece sabit olması ve gelirde genel bir düşüş yaşanmasıyla ilgilidir. Günümüzde DRG/DIP ve paket bölünmelerinin büyük etkisi vardır ve sektörün dönüm noktası henüz gelmemiştir.

02

Ekipman İhaleleri Toparlanıyor;

IVD Hâlâ Baskı Altında

2025 üçüncü çeyrek raporundan, tıbbi cihaz sektörünün genel gelir büyüme oranının hâlâ negatif olduğu ancak 2025 Üçüncü Çeyrekte tek çeyreklik gelir büyüme oranının pozitife döndüğü görülmektedir. Brüt kâr marjı açısından ise 2025'ten bu yana hafif düşüş eğilimi göstermiştir ve bu durum özellikle ekipman, tüketim malzemeleri ve IVD gibi alanlarda merkezileştirilmiş satın alma uygulamalarının ilerlemesiyle ilişkilidir.

Bunların arasında ekipman sektörü toparlanmıştır. Bu yıl Ocak ile Eylül arasında tıbbi ekipmanların terminal satın alma işlemleri devam eden bir şekilde iyileşmiştir. Şirketler stoklarını azaltmaya devam etmiş ve üçüncü çeyrek finansal tablolarında toparlanma belirtileri görülmüştür; gelirde önemli ölçüde yıllık artış kaydedilmiştir. Hissedarlara atfedilen net kâr ve hissedarlara atfedilmeyen net kârın düşüşü daralmış ve brüt kâr marjı temel olarak istikrarlı hâle gelmiştir.

Guojin Securities verilerine göre, tıbbi cihaz sektörünün geliri 2025 üçüncü çeyreğinde bir önceki yıla kıyasla %10,65 arttı ve bu durum yerli tıbbi cihaz endüstrisinin düşüş dönemi sona erdi.

Bu yılın ilk yarısında, yerli ekipman ihale talebinde toparlanma eğilimi görüldü. Aynı zamanda, yerli öncü işletmelerin pazar payı sürekli artış gösterdi ve kanal envanterinin stok azaltma süreci son aşamaya girdi. Dördüncü çeyrekte toparlanmanın hızlanması bekleniyor. Ancak, ilçe düzeyindeki orta ve düşük seviye ürünlerin merkezileştirilmiş alım fiyatları nispeten düşük olduğu için kısmi etkiler devam etmekte. Gelecekte, öncü işletmelerin yüksek uçlu ürünler oranının ve yurt dışı iş hacminin artmasıyla birlikte brüt kâr marjının giderek toparlanması bekleniyor.

Guojin Menkul Kıymetler verilerine göre, tıbbi sarf malzemeleri sektörünün 2025'in 3. çeyreğindeki tek çeyreklik geliri bir önceki yıla göre %0,50 azaldı. DRG politikasının ulusal düzeyde teşvik edilmesiyle birlikte, bazı cerrahi talepler kısa vadede hafif bir baskı altında kaldı. Aynı zamanda, tarife politikalarındaki değişiklikler, bazı düşük değerli sarf malzemelerinin ihracatında belirli bir fiyat baskısına yol açtı.

Tıbbi sarf malzemelerinin satış gider oranı üçüncü çeyrekte %13,25'e ulaşarak bir önceki yıla kıyasla %0,80, bir önceki aya kıyasla %0,74 arttı. Rekabetin giderek kızıştığı bu ortamda, şirketlerin pazarlama giderlerine yaptığı yatırım da önemli ölçüde artış gösterdi.

İn vitro tanı sektörünün tek çeyreklik geliri 2025Y3'te bir önceki yıla göre %13,07 azaldı. DRG/DIP ve hastane denetimlerinin karşılıklı tanınması gibi önlemler birçok gereksiz test talebini azalttı ve sektörün talebi kısa vadede belirgin baskı altında bulunuyor. Ayrıca, hacme dayalı tedarikin sürekli uygulanması ürün fiyatlarının düşmesini teşvik etti. Ancak uzun vadede, bunun yerelleştirme oranının artmasını da desteklemesi bekleniyor ve öncü işletmelerin pazar payı büyümesi hızlanacak.

Genel olarak, tıbbi cihaz sektörü üzerindeki baskı hâlâ devam ediyor ancak şafağın eşiğindeyiz. Size hızlı referansınız için temel verilere ve sektörel trendlere odaklanan basitleştirilmiş İngilizce özet belgesi hazırlamamı ister misiniz?